A Fractional CFO is a part-time financial expert hired by a company to provide high-level financial strategy and expertise without the full-time commitment or cost of a traditional chief financial officer.

Business leaders must offload key operational tasks as their operations grow or they’ll hinder the growth process. Senior management positions must be filled using a strategic approach that acquires the best talent possible.

Fractional services often make sense when hiring full-time is not financially viable.

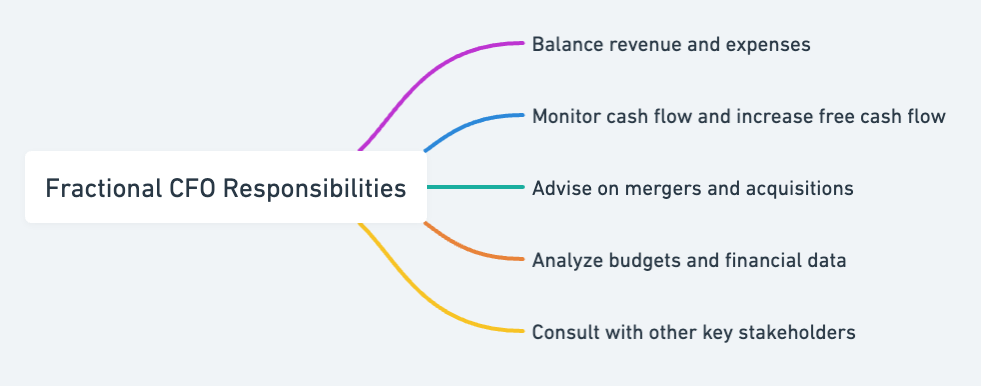

A fractional CFO, also known as a part time CFO or freelance CFO, is one role that helps businesses stay on track financially. The role of a chief financial officer is to:

- Balance revenue and expenses

- Monitor cash flow and increase free cash flow

- Advise you on mergers and acquisitions

- Analyze budgets and financial data

- Consult with other key stakeholders

CFOs can help in a wide range of capacities, assisting companies to make smarter financial decisions, keep expenses down and better manage cash flow.

Some things a part time CFO can take on. This will vary by stage:

What Is a Fractional CFO?

“Fractional” executives work in a freelance-type of capacity – as many hours as you wish – which may be part time for the short- or long-term. Often, a freelance CFO in this capacity will work:

- 20 hours or less per week with the business

- In very specific capacities

- A contract-specified duration

You can hire a part time CFO for very specific responsibilities, such as to assist with a merger or to help build your internal accounting department, or to fill in multiple roles and capacities,

Depending on the fractional CFO, they may work:

- Hourly

- Daily

- Weekly

- Monthly

Retainers are common, but you’ll want to discuss contract arrangements with the executive to come to terms that best meet your company’s needs. Like other fractional execs like a Fractional CRO or COO, the working arrangement will depend on your unique circumstances.

Why Hire a Fractional CFO?

Part time CFOs are integral to the success of many small businesses, startups and enterprises. A top priority of 90% of these executives in 2023 was to evaluate a business’s functional scope and strategies.

Working with a freelance CFO goes well beyond these functions and can benefit businesses in other key areas, too.

- Fractional CFOs offer the management experience of a full-time CFO at a lower cost on a part time basis.

- Expertise across many industries, which allows for new, innovative ways to handle a company’s financial management.

- Improvement of financial processes. Freelance CFOs can help with strategic planning, developing processes, budgeting, analysis and fundraising.

- Scalability options, such as methods to expand financial strategies as the company grows.

- Long-term planning to help companies better manage low cash flow situations.

- Regulatory compliance and setting internal controls.

Part time CFOs work in the capacity that best fits businesses at multiple stages in their operations. Managers can offload time-intensive tasks that are outside of their expertise to the CFO, allowing them to focus on core tasks and gain access to expert talent.

What Does a Fractional CFO Do?

CFOs work in multiple capacities that can change from one business to the next. It’s not uncommon for a freelance CFO to help one company with long-term financial projections and another with customer segments.

Extensive expertise in multiple areas allows fractional CFOs to work in:

- Specific challenges: Organizations can bring in a part time CFO when they need to address challenges that are complex. For example, if cash flow issues arise or gross profit margins are too low to be sustainable, the chief financial officer can be brought into the business to help address these concerns.

- Financial visibility: Short- and long-term financial visibility can help you better run your business and prepare for the future. Freelance CFOs can prepare budgets, help with forecasting or try to better understand markets. These forecasts are crucial when goal setting and will direct a business from where it is currently to where it needs to be to reach its goals.

- Growth: Scaling a business is a top priority for many owners, but it is also a challenge. You’ll outgrow technologies and systems, processes will no longer work and new markets will bring their own challenges. CFOs can implement new systems, understand where costs overrun and assist with growth friction.

- Financial goals: These fractional executives can assist with financial forecasts, board meetings, strategic relationships, contracts, managing books and more. If you need to raise money or want to prepare for a merger or acquisition, a part time CFO can help.

Certain part time CFOs may be a better fit than others for your business, depending on its stage of operation and the CFOs expertise. You’ll find experts in this position who focus on areas that they have intense interest in.

For example, you may find one of these freelancers who specializes in mergers and acquisitions. While they have skills in many areas, they have invaluable knowledge in this area and can better assist you than a non-specialist.

You need to know what to look for in a CFO to find an executive that best fits your company.

What To Look for In a Fractional CFO Leader

Net profit growth in 2024 is projected by 76% of CFOs, but making the wrong financial decisions can keep your business from reaching this goal. Selecting the right leader for your business will require you to do your due diligence and know what to look for in one of these professionals.

You can begin your search by considering the expert’s:

- Track Record

What has the CFO done in the past? If you want to hire a freelance CFO for a merger, it may be worthwhile finding a professional who can show you other mergers that they helped with. If you need a CFO to assist with cash flow management, what is their track record helping others in this area?

You can ask the part time CFO for their stats on helping other businesses and if they can share any other success stories.

- Experience

CFO experience is crucial to your success. When interviewing one of these executives, you’ll want to consider:

- Has the fractional CFO worked in the same industry as your business?

- Does the person have experience in a similar industry?

You can hire someone who has diverse experience and can fill the role perfectly, but experience in your industry may be invaluable.

- Expertise

Do you need a specialist? If so, you’ll want to seek an expert in the area. If you’re struggling to maintain cash flow during rapid growth periods, you may want a part time CFO with expertise in cash flow management.

- Culture

Over 81% of managers believe that cultural fit is crucial to employees staying with an organization. A CFO must fit into the business culture seamlessly and align with your goals and interests.

If the CFO isn’t a good fit, they may be unable to provide the same level of service as someone who is a seamless fit.

- Leadership

Can the CFO you’re planning to hire instill faith in your team and command a room? If not, they may lack the leadership skills your business requires.

Fractional CFO Services

Part time CFOs offer a wide range of services, but before listing them in detail, let’s analyze how they may help a startup differently than they do a small business.

Part Time CFO For Startups

Startups, especially in the early stages, will have very unique needs. Your business viability will remain in question until you have steady revenue and cash flow. A startup can often benefit the most from:

- Financial Strategy and Planning: Developing short and long-term financial strategies that align with the company’s goals.

- Budgeting and Forecasting: Creating and managing budgets, and forecasting future financial needs and growth.

- Cash Flow Management: Ensuring the company maintains adequate cash flow to fund operations and growth initiatives.

- Financial Reporting and Analysis: Preparing financial reports, analyzing financial data, and providing insights to inform decision-making.

- Fundraising and Capital Structure: Assisting with raising capital, whether through equity, debt, or other means, and advising on the company’s capital structure.

- Cost Control and Expense Management: Identifying areas to reduce costs and improve operational efficiency.

- Compliance and Risk Management: Ensuring compliance with financial regulations and managing financial risks.

- Financial Systems and Processes: Implementing or improving financial systems and processes for better efficiency and accuracy.

- Investor Relations: Communicating with current and potential investors, and preparing financial presentations for investor meetings.

- Mergers and Acquisitions: Providing guidance on potential mergers, acquisitions, or exits.

- Tax Planning and Strategy: Advising on tax planning strategies to optimize the company’s tax position.

CFOs can provide startup-specific guidance that will guide you through the initial, formative stages of operation.

Part Time CFO For SMBs

SMBs will have different needs from a startup. The goal may be to achieve financial stability or sustainable growth. Specifically, a fractional CFO can step in to assist with:

- Optimizing and improving cash flow by managing collections and payments and monitoring cash balances.

- Strategic financial advice. Fractional CFOs can provide business owners with guidance to help them achieve their goals and make more informed decisions. They can develop financial models and analyze data to inform strategic planning.

- Gaining access to capital. Fractional CFOs can prepare funding proposals and even negotiate with lenders and investors to get the best possible terms for the business.

- Improving financial visibility by providing financial reports, implementing effective accounting systems and analyzing data to identify trends.

A fractional CFO can step in to help an SMB achieve its vision and goal. However, these aren’t the only services that these professionals offer.

List of Fractional CFO Services

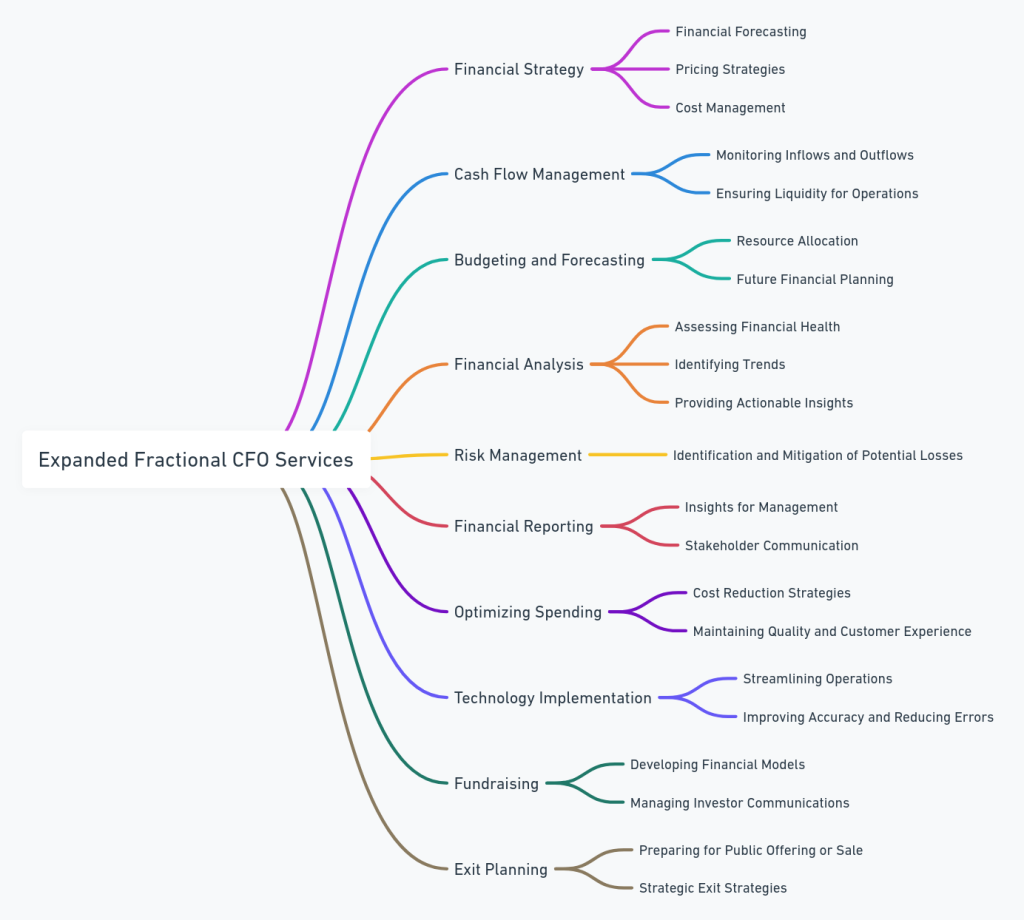

Part time CFOs offer a wide range of services, including but not limited to:

- Financial strategy, including financial forecasting, pricing strategies, cost management and more.

- Cash flow management to ensure there’s enough liquidity to support operations.

- Budgeting and forecasting to ensure resources are effectively allocated.

- Financial analysis, including assessing the organization’s financial health, identifying trends and providing actionable insights to help with planning.

- Risk management, including the identification and mitigation of potential losses and financial challenges.

- Financial reporting to provide insights for management and stakeholders.

- Optimizing spending to cut back on expenses without compromising on quality or the customer experience.

- Technology implementation to help streamline operations while improving accuracy and reducing errors.

- Fundraising for organizations that want to raise capital via angel investors, venture capital or loans. Fractional CFOs can develop financial models and financial projections while managing investor communications.

- Exit planning to ensure the organization is prepared if it goes public or is sold.

Freelance CFOs can also assist with tasks that are unique to a business or even be hired for short-term projects that require specialized expertise.

How to Become a Fractional CFO

If your goal is to transition into a fractional CFO role, having the right combination of education, experience and network connections can help.

- Education

To pursue a career as a fractional CFO, you will need a strong background in accounting, finance or a related field. At minimum, you will be expected to have a bachelor’s degree, but having a master’s degree in business administration can give you an advantage.

Pursuing a Certified Public Accounting (CPA) designation can also be beneficial.

- Experience and Expertise

Getting your foot in the door in a finance-related role can help you gain the vital experience you will need to transition to a fractional CFO role, such as accountant, financial analyst or controller.

Gaining experience with strategic planning, financial modeling and financial analysis will allow you to develop important skills you will need as a fractional CFO.

Improving your consulting skills will be essential.

- Network and Market Yourself

Networking will play an important role in helping you move into a fractional CFO position. Start making connections with other industry professionals early on.

- Make sure that you’re attending industry events and seeking out mentors.

- Develop your online presence and leverage platforms like LinkedIn to form new connections.

Continuous Learning

Once you’ve entered a role as a fractional CFO, continuous learning should be a priority.

The world of finance is constantly evolving. To succeed in a career as a fractional CFO, you will need to stay ahead of these changes. Invest in advancing your knowledge and consider pursuing further certifications to bolster your credibility and expertise.

What is an Average Fractional CFO Hourly Rate?

A fractional CFO’s hourly rate will depend on several factors, including:

- Your organization’s location

- Their level of experience

However, on average, fractional CFOs are paid between $175 and $300+ an hour for their services.

Pros and Cons of Using a Fractional CFO Leadership

Fractional CFO leadership has many advantages, but there are some potential cons that should also be considered.

| Pros | Cons |

| Speed to hire | Limited availability |

| Flexible commitment | Not a FT team member |

| Access expertise | |

| Cost effective |

Pros of a Part Time CFO

Fractional CFO leadership offers a variety of benefits:

- Get the Expertise You Need Now

One primary advantage of fractional leaders is that they can step in right away and start providing the expertise you need.

Fractional CFO executives can fill the gaps in your C-suite and leverage their years of experience to steer your startup or SMB in the right direction.

In particular, a fractional CFO can step in to implement initiatives like improving forecasting accuracy, optimizing pricing, improving inventory management and more.

- No Full-Time Commitment

Hiring a fractional chief financial officer executive allows you to leverage the expertise you need without the commitment of hiring a permanent, in-house position.

Many startups and SMBs are not in the financial position to hire another full-time fractional CFO executive. A fractional hire allows organizations to save on the expense of hiring and also avoid the high cost of hiring the wrong CFO executive.

Because if a permanent executive is a poor fit for the organization, they’ll have to incur the time and financial expense or hiring all over again.

A fractional CFO is a low-risk way to get the leadership your company needs.

Additionally, fractional leadership gives you the ability to scale up or scale back as needed to meet the demands of your business.

Cons of a Part Time CFO

The flexibility of hiring a fractional CFO is undeniably beneficial, but there are some potential drawbacks that should be considered.

- Availability May be More Limited

A fractional CFO is not a permanent member of your team, so their availability may be more limited. Fractional executives work on a part-time basis, and their services are in high demand.

They may work with multiple clients, so they may not be able to address your needs on demand.

- Not a Full-Time Member of the Team

Fractional executives are not permanent members of the team, so they may not develop the same level of relationships with your team as an in-house employee.

How To Hire a Fractional CFO

You can connect with fractional CFOs via referrals, industry events, social media platforms (like LinkedIn) or even on freelancer websites. Or use a sales recruiting firm.

However, many organizations have never hired a fractional executive and don’t know how the process works.

A marketplace like RevPilots can help steer you in the right direction by providing:

- Recommendations

- Unbiased guidance

- Connections with vetted fractional executives

Navigating the world of fractional hiring can be complex. Having the help of experienced professionals can help streamline the process.

Fractional CFO vs Bookkeeper

When comparing a fractional CFO to a bookkeeper, it’s important to be aware of the clear differences.

A fractional CFO offers strategic financial leadership and high-level financial management, suitable for businesses needing expert financial guidance without hiring a full-time CFO.

A bookkeeper, on the other hand, handles the day-to-day financial record-keeping and transactional activities of a business. Both roles are important, but they serve different needs within an organization.

| Fractional CFO | Bookkeeper |

| Strategic Financial Leadership | Day-to-Day Financial Transactions |

| Part-Time or Temporary Basis | Financial Record Keeping |

| Financial Analysis and Insights | Reconciliation and Reporting |

| Fundraising and Investment Strategies | Operational Role |

| Budgeting and Forecasting | Basic Qualifications and Skills |

| Experience and Expertise | No High-Level Financial Strategy |

Fractional CFO Responsibilities

- Strategic Financial Leadership: A fractional CFO provides high-level financial strategy and guidance. They are involved in strategic planning, financial forecasting, risk management, and advising on long-term financial decisions.

- Part-Time or Temporary Basis: They work on a part-time, temporary, or project basis, offering their expertise without the commitment or cost of a full-time CFO.

- Financial Analysis and Insights: They analyze financial data to provide insights, identify trends, and advise on business opportunities or potential risks.

- Fundraising and Investment Strategies: Fractional CFOs often assist with capital raising, investor relations, and managing complex financial transactions.

- Budgeting and Forecasting: They oversee the budgeting process, financial forecasting, and help in aligning financial goals with the business strategy.

- Experience and Expertise: Typically have extensive experience and expertise in financial management, often with a background in senior financial roles.

Bookkeeper Responsibilities

- Day-to-Day Financial Transactions: A bookkeeper is responsible for recording and maintaining the business’s daily financial transactions, such as sales, purchases, payments, and receipts.

- Financial Record Keeping: They ensure accurate and orderly records of financial activities, which are crucial for accurate accounting and financial reporting.

- Reconciliation and Reporting: Bookkeepers reconcile bank statements and may generate basic financial reports such as balance sheets, income statements, and cash flow statements.

- Operational Role: Their role is more operational and less strategic compared to a freelance CFO. They focus on the details of recording and organizing financial data.

- Qualifications and Skills: Bookkeepers generally do not require the advanced financial qualifications or strategic experience that a part time CFO possesses. They are skilled in accounting practices and bookkeeping software.

- No High-Level Financial Strategy: Unlike a CFO, bookkeepers do not typically engage in high-level financial planning, analysis, or decision-making.